Fintech UX Design: Challenges and Best Practices

07.04.2023

Fintech UX design

Fintech UX design is increasingly becoming the cornerstone of the fintech industry as technology rapidly advances. In this dynamic sector, fintech UX design plays a crucial role in helping companies not only adapt to new trends and regulations but also maintain user-friendliness and compliance. There’s a delicate balance to maintain, but by prioritizing fintech UX design, these companies can ensure a positive experience for their users.

Let DOOR3, a UX design agency for banking and fintech, take you through our holistic guide on fintech UX design.

What exactly is fintech UX design?

Fintech UX design stands as the meticulous process of crafting user-friendly and intuitive digital experiences within the domain of financial technology products and services. This practice is pivotal in bridging the complex world of finance with the rapidly evolving realm of technology, ensuring that users can navigate and utilize financial applications with ease and efficiency. It’s about transforming the traditionally rigid and complex landscape of financial services into a streamlined, accessible, and engaging digital experience. As we delve deeper into the digital age, the role of fintech UX design becomes increasingly critical, underpinning the success of countless apps and platforms that aim to simplify, secure, and enhance our financial interactions.

Tom McClean, Design Practice Lead at DOOR3, likens fintech UX design to “the bridge connecting two islands—finance and technology. Without a well-designed bridge, it’s not only hard to cross from one side to the other, but you might not even want to start the journey. A great fintech UX design invites users to cross this bridge with confidence, transforming what can be a daunting financial task into an empowering and even enjoyable experience.”

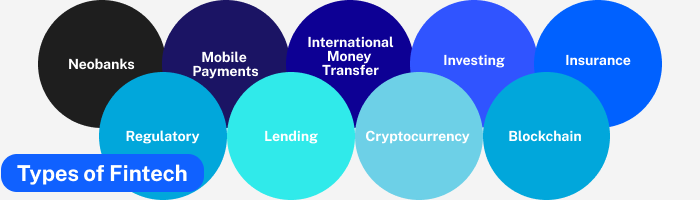

Here are some examples of companies where fintech UX design is pivotal:

-

Neobanks (also called digital banks): Chime, Nubank

-

Mobile payments: Square, Venmo

-

International money transfers: Wise, WorldRemit

-

Investing: Gotrade, Wealthfront

-

Insurance: Oscar, Lemonade

-

Regulatory: Onfido, ComplyAdvantage

-

Lending: Kabbage, LendingClub

-

Cryptocurrency: Coinbase, Gemini

-

Blockchain: Chain, Bitfury

Fintech Innovation Through UX: DOOR3’s Pivotal Project

DOOR3’s work with LMRKTS

The DOOR3 project for LMRKTS, a company specializing in financial optimization and compression services, underscores the critical role of finance UX design in modernizing financial platforms. Faced with a portal that lacked the sophistication of its offerings, LMRKTS enlisted DOOR3 to elevate its user experience through strategic design enhancements. DOOR3 focused on a few elements to greatly expand design functionality:

1. User-Centered Design Approach:

Focused on creating an intuitive and engaging portal interface that mirrors the innovation of LMRKTS’ services, ensuring ease of navigation and a seamless user journey.

2. Expanded Functionality:

Leveraged foundational design mocks to build out new features that met business and user needs, enhancing the overall utility of the portal.

3. Iterative Design Process:

Committed to ongoing refinement based on user feedback and interaction data, emphasizing the importance of adaptability in finance UX design.

The revamped portal that came out of this effort not only aligns with the sophisticated nature of LMRKTS’ products but also sets a new standard for user experience in the fintech UX design industry, illustrating DOOR3’s ability to fuse technical innovation with user-centric design.

How can you achieve a successful fintech user experience?

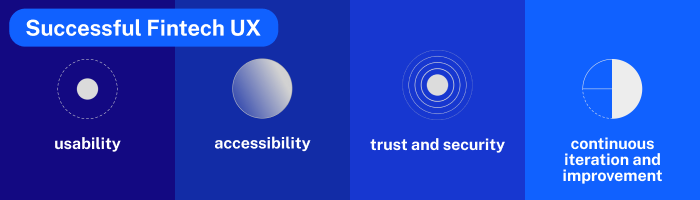

Fintech UX design revolves around four key elements:

Usability

Fintech UX design should prioritize intuitive design that is efficient and easy to navigate. Designing for fintech will be extra impactful when designs are personalized to users and their specific needs. Leverage data to offer customized recommendations and notifications so users feel valued.

“Usability isn’t just about making things easier to use; it’s about making financial services personal and impactful. At DOOR3, we delve deep into the data, understanding user behaviors and preferences to craft experiences that not only meet but anticipate user needs. This approach transforms a simple transaction into a personalized journey, making each user feel uniquely valued.”

– Bailey Costello, Senior UX Designer at DOOR3

Accessibility

Because a diverse range of users implements fintech, platforms must be accessible, with features like screen readers and visual or audio cues, for people with visual impairments and motor disabilities. Fintech UX design must also reflect each user’s preferred language and currency.

Trust and Security

Fintech platforms are operating with money, so users are particularly concerned with security. Once customer trust is broken, it’s difficult to rebuild. Implementing strong security measures in fintech UX design, such as two-factor authentication and data encryption, is crucial to maintain user trust.

Financial organizations are some of the most vulnerable to cyber attacks. It’s much more affordable to invest in cyber security sooner rather than later, as IBM details in their Cost of a Data Breach Report 2022. Last year, the average cost of a data breach was $4.35 million, an all-time high in IBM’s 17 years of research.

Continuous Iteration and Improvement

As with any UX experience, the work is never done. Fintech companies must recognize that UX design for fintech is an ongoing process. It involves continuously seeking user feedback, analyzing their data, pinpointing areas for improvement, and regularly updates. Additionally, there must be clear avenues for customer support for ongoing user satisfaction.

“The landscape of fintech UX design is ever-evolving, and so are user expectations. At DOOR3, we try to embody the principle of continuous improvement, not as a task, but as a culture. By employing Agile methodologies and fostering an environment of open feedback, we ensure that our fintech solutions are always at the cutting edge, providing unmatched user experiences that grow and adapt with time.”

– Cassie Ang Yu, UX Designer at DOOR3

To ensure the best fintech website designs, DOOR3, a UX design agency for banking and fintech, employs client specific strategies and uses Agile methodology centered on our core principles. These include adopting a user-centered design approach to ensure usability and personalization, ensuring accessibility through inclusive design practices, maintaining trust and security with advanced security measures, and committing to continuous iteration based on user feedback and data analysis.

DOOR3 emphasizes the importance of adapting to evolving user needs and technological advancements to keep fintech platforms secure, accessible, and user-friendly.

What are the specific fintech UX design challenges experienced by DOOR3?

In the fintech industry, merging innovation with stringent regulatory requirements while ensuring a seamless user experience is a formidable challenge. Yet, this is where DOOR3 has demonstrated unparalleled expertise, particularly in its collaboration with AIG to develop a Business Intelligence Dashboard that emphasized regulatory compliance, simplification of complex financial processes, and fortified data security.

Navigating the regulatory maze

DOOR3’s approach to tackling regulatory challenges for AIG involved an innovative, layered strategy. Recognizing the essential need for compliance without compromising on the user experience, the team embarked on a thorough analysis of the regulatory landscape. This exhaustive groundwork enabled them to integrate compliance into the designing for fintech process seamlessly, turning potential restrictions into features that enhance user trust and safety.

For instance, leveraging dynamic data visualization tools allowed the dashboard to not only present real-time financial data in a digestible format but also to ensure that this presentation was in strict alignment with global financial regulatory standards.

Simplifying complex financial processes

The complexity of financial processes often poses significant barriers to user engagement and satisfaction. DOOR3’s creative prowess shone through in its ability to deconstruct and streamline these complexities for AIG’s dashboard. By employing user-centered design principles, the team devised intuitive interfaces and navigation pathways that simplified the user journey. Real-world user testing played a crucial role here, ensuring that the end product was both powerful and accessible.

One standout example was the development of a customizable dashboard feature, enabling users to tailor their view according to their specific needs and preferences. This flexibility not only made the dashboard more user-friendly but also significantly reduced the cognitive load on users, making it easier for them to access, interpret, and make informed decisions based on their financial data.

Enhancing data security with seamless UX

In the Fintech domain, data security is paramount, yet increasing security measures can often lead to a cumbersome user experience. DOOR3’s strategy as a UX design agency for banking and fintech was to embed security within the UX design in a way that was both effective and invisible to the user. Advanced encryption and multi-factor authentication methods were integrated smoothly into the user flow, enhancing security without adding unnecessary steps or complexity.

Why must fintech companies prioritize finance UX design?

Designing for fintech efficiently is necessary for a positive user experience, making it a worthwhile long-term investment for your company for several reasons:

Trust and credibility

As we mentioned above, trust is extremely valuable for fintech companies. The best fintech website designs are going to make the first impression when users are determining whether or not they can rely on your service. If your platform is well-designed and intuitive, customers will be more likely to feel assured that their financial information is secure.

User engagement and retention

One way to reduce customer churn is to keep users satisfied with your platform through well developed finance UX design. Acquiring new customers costs five to seven times more than retaining existing ones, so engaging UX design for finance must be a priority for fintech companies. Additionally, customers will be more likely to recommend your company to others.

Regulatory compliance

A well-designed user interface can clearly communicate terms, fees, and policies to meet legal obligations and guide users through any necessary steps for obtaining required consent. These regulations can be confusing for users, but good UX design for finance can simplify this complex information and walk users through seamlessly.

Competitive advantage

In such a highly competitive industry, superior UX for financial services may be the advantage that your company needs to capture a user’s attention. Customers are much more likely to choose a platform that is intuitive and easy to use, which can be achieved through best UX design practices.

Cost savings

Good UX design for finance will reduce the risks of costly security breaches and errors, and with increased user satisfaction, you will have lower customer support costs, not to mention the cost savings of attracting and retaining customers.

Don’t just take our word for it, see what our clients say:

“Since we’ve launched this, our number of assessments has gone up because the software is intuitive, easy to use and faster to use. Now, salespeople are eager to use the tool.”

– Sr Product Mgr, Personal Protection Equipment Manufacturer

“We’ve received a lot of great feedback from our clients on the tool and the experience, and we’re constantly working on it.”

– Director of Product Management, Elsevier

“Long-term clients have been saying that the new design feels modern and fresh. Everyone’s really excited.”

– Sushant Kataria, software firm director

What are the specific fintech UX design challenges?

Meeting regulatory and compliance restrictions

Because of the high risk of financial fraud in the fintech industry, companies must meet various regulations and compliance requirements. UX designers are responsible for being well-versed in these legal obligations so the UX design can highlight any disclaimers and data protection standards that must be met, such as AML (anti-money laundering) and KYC (know your customer).

Security and trust

Providing security for users and their data is crucial for fintech companies, who are among the most likely to be targeted for cyber security attacks. Many users choose simple passwords that leave them vulnerable to bad actors, so it’s up to companies to design systems that will not accept passwords that are too easy to crack and provide two-factor authentication.

The best fintech website designs must find the balance between usability and security for a positive user experience.

Complexity of financial processes

In addition to the fintech UX design challenges posed by meeting legal obligations and fostering trust, fintech companies have many complex elements that can be overwhelming for users. Additionally, users risk reaching cognitive overload when faced with the many questions fintech companies must present. Good UX design for finance can help companies provide clear explanations and tools to assist users in their decision-making.

Keeping up with technological advancements

New technologies, trends, and innovations are constantly emerging in the fintech industry, making it a challenge for fintech designers to stay updated and keep their designs relevant and competitive. Because bad actors and cyber attackers are also constantly innovating, there must be an emphasis on continuously updating security measures.

Balancing automation and human interaction

It’s the responsibility of fintech companies and their UX design strategies to help users effortlessly manage their spending habits and funds. Automation and AI are great for simple processes, but they cannot understand context, ethics, and morals. Fintech UX designers must consider the risks and benefits of both automated processes and opportunities for human interaction.

How can designers overcome these fintech UX design challenges?

Simplify processes

The financial processes and regulations in the fintech industry can be extremely complex for users. Simplify these steps as much as possible, using clear and concise language, providing tooltips, and implementing progress bars so users know where they are in the process.

At the top of onboarding forms, highlight the user’s value proposition, and prefill forms for existing customers when they apply for a new product or service. While fintech designers should be familiar with regulatory requirements, consider collaborating with compliance experts to ensure the necessary regulations are met.

While it may seem counterintuitive, it is also important for fintech companies to implement small hurdles in the user flow, or positive friction, to prevent impulsive actions or simple mistakes.

Maximize displays

Because fintech companies are required to display large amounts of data, UX design for finance can be implemented to simplify the user experience and reduce overwhelm. Be aware of how labels, colors, fonts, and headings are being utilized, and consider what content can be labeled as secondary and dispersed behind carousels or accordions.

When it comes to long forms, divide them into separate steps and keep users informed on how long the form should take to complete as well as how much progress they have made. Allow users to save progress and return at a later time if necessary.

Enhance trust and security

Without compromising usability, embed strong security measures into the design like two-factor authentication, data encryption, and more, and communicate how you’re protecting data to users. Empower customers by giving them control over privacy settings and permissions.

Stay updated with industry trends

Continuously expand your knowledge of new trends, technologies, and user expectations. Engage with other professionals in the industry, attend conferences, and incorporate your learnings into your designs. Additionally, fintech companies should conduct user testing and gather feedback through the design process and beyond.

Personalization

Interfaces should be customizable based on user preference, with recommendations based on users’ financial history and goals. This may also include finding opportunities to educate users. Consider incorporating game design elements for an interactive and enjoyable user experience.

Best Fintech UX Design Practices Followed by DOOR3

At DOOR3, a UX design agency for banking and fintech, we prioritize best practices in our UX design. Our process ensures that every fintech UX design solution we craft is intuitive, secure, and user-centered. Follow our approach and see your success manifest!

User research

Understanding the end-user is the foundation of any successful fintech product design. At DOOR3, we begin our process with in-depth user research to gain insights into the needs, behaviors, and pain points of our target audience. This involves a mix of quantitative and qualitative methods, including surveys, interviews, and market analysis. By building a detailed user persona, we ensure that our design decisions are informed and targeted, creating a product that truly resonates with its users.

Prototyping

Prototyping is an essential step in our design process, allowing us to bring our research findings to life. DOOR3 leverages advanced prototyping tools to create interactive models of the proposed fintech UX design solutions. This enables us to visualize and test the functionality, design elements, and user flow early in the development cycle. Prototypes serve as a valuable communication tool, facilitating discussions among fintech designers, developers, and stakeholders, ensuring alignment before moving into the development phase.

Usability testing

Usability testing is key to refining and validating our design choices. At DOOR3, we conduct comprehensive usability tests with real users to identify any usability issues and areas for improvement. This iterative process allows us to see how users interact with the prototype, providing insights into user behavior, preferences, and obstacles they may encounter. By addressing these findings early, we enhance the overall user experience, ensuring the final fintech product design is not only functional but also intuitive and engaging.

Iterative design

DOOR3 embraces an iterative design approach, continually evolving our solutions based on ongoing user feedback and technological advancements. After the initial launch, we closely monitor user engagement, collect feedback, and analyze performance data. This ongoing analysis informs our iterative updates, allowing us to adapt and refine the fintech product design over time. This commitment to continuous improvement ensures that we deliver the best website designs and remain at the forefront of innovation, providing lasting value to users and businesses alike.

At DOOR3, our process is designed to navigate the complexities of fintech UX design, ensuring that every project we undertake is poised for success. By combining user research, prototyping, usability testing, and iterative design, we create fintech solutions that are not just usable but truly transformative, enhancing the financial well-being of users around the globe.

Fintech UX Designers

Maybe you’ve been wondering what qualifications or experience does your UX team need to create the best fintech website designs? DOOR3 has assembled a team of UX designers whose diverse backgrounds and deep fintech industry knowledge stand out. Tom McClean, Cassie Ang Yu, and Bailey Costello exemplify the high caliber of talent within DOOR3, each bringing unique skills and experiences that contribute to the firm’s success in delivering intuitive and innovative fintech UX design solutions.

Tom McClean: A Blend of Creative Design and Strategic Thinking

Tom McClean’s journey through the design world has been marked by a continuous expansion of his skill set, from his foundational education at Bauhaus University to leadership roles in UX design. His approach combines creative design with strategic thinking, enabling the creation of user-centric fintech solutions that are not only aesthetically pleasing but also highly functional. Tom’s leadership in UX for financial services is complemented by his work in fostering a design culture within teams, emphasizing the importance of service design thinking in creating impactful user experiences. His recognition in the industry, through awards such as the ADC of Europe and ADC of Germany, underscores his ability to navigate and innovate within the complex fintech ecosystem.

Cassie Ang Yu: Fostering Community and Leading by Example

Cassie Ang Yu’s comprehensive background in UX for financial services is bolstered by her active engagement with the design community through co-leading the SDN New York Chapter. Her expertise extends from creating engaging digital experiences into organizing events and creating content that brings the design community together. Cassie’s academic achievements, including a dual degree from Parsons School of Design - The New School, provide her with a deep understanding of service design and urban studies, enriching her approach to UX design in fintech. Her skills in user experience design and prototyping have been sharpened across a variety of projects, demonstrating a commitment to excellence and continuous learning.

Bailey Costello: Technical Savvy Meets User-Centric Design

Bailey Costello’s path from application development internships to a senior UX design role at DOOR3 showcases her blend of technical savviness and user-centric design philosophy. With a Bachelor of Science in Computer Science from the University of Nebraska at Omaha, Bailey has a solid technical foundation that enhances her UX design work. Her experience spans designing and developing employee-facing applications to leading UX design for fintech solutions at DOOR3, where she excels in creating intuitive, engaging digital products. Bailey’s ability to navigate agile development environments and implement UX-based decisions has made her a pivotal figure in crafting fintech solutions that meet and exceed user expectations.

Uniting Diverse Talents to Innovate in Fintech UX Design

The expertise and qualifications of Tom, Cassie, and Bailey illustrate the depth of talent at DOOR3, where diverse backgrounds and a shared passion for innovation converge to drive the future of fintech UX design. Their collective experiences not only highlight individual achievements but also underscore the collaborative spirit that characterizes DOOR3’s approach to creating digital solutions.

Don’t just take my word for it, see what COO & Partner, Phil Necci, had to say about our work for Financial Information Incorporated:

“There are no downsides to working with DOOR3. Their constant communication is notable. Many of our software development projects have been client-specific, and DOOR3 has delivered on each client’s particular needs.”

Applying current fintech UX trends to increase profitability

DOOR3, with its deep expertise in fintech UX design, applies current trends to elevate the user experience and, in turn, boost profitability for its clients. By focusing on AI-driven personalization, omnichannel experiences, and enhanced data visualization, DOOR3 ensures that any fintech product design we create is not only user-friendly but also highly engaging and efficient. Here’s how DOOR3, a ux design agency for banking and fintech, incorporates these trends to benefit its clients:

AI-driven Personalization

DOOR3 leverages AI to create personalized user experiences in fintech applications. By analyzing user data, behaviors, and preferences, DOOR3 designs systems that offer personalized product recommendations and custom alerts. This level of personalization not only improves user engagement but also significantly increases the likelihood of cross-selling and upselling opportunities, directly impacting profitability.

Omnichannel Experiences

DOOR3 excels in creating seamless and consistent experiences across all user touchpoints. Understanding the importance of a unified user experience, DOOR3 ensures that its fintech UX design solutions provide a cohesive journey whether the user is on a mobile app, web platform, or any other device. This omnichannel approach not only enhances the overall user experience but also strengthens brand loyalty and encourages more frequent interactions with the service, ultimately leading to increased profitability.

Enhanced Data Visualization

With an emphasis on making complex financial data understandable and actionable, DOOR3 employs advanced data visualization techniques in its fintech UX designs. Interactive graphs, comprehensive dashboards, and intuitive charts allow users to grasp their financial situation quickly, make informed decisions, and monitor their goals efficiently. By improving clarity and trust, DOOR3’s focus on data visualization significantly contributes to user engagement and retention.

DOOR3’s strategic application of current fintech UX design trends plays a crucial role in enhancing user experiences, fostering loyalty, and driving profitability. By focusing on personalization, accessibility, consistency, and clarity, DOOR3 not only meets the evolving needs of fintech users but also ensures its clients stay at the forefront of the digital finance landscape.

Don’t skimp out on fintech design

“I can confidently say that skimping on UX in fintech is a critical mistake that companies cannot afford to make. In a competitive industry full of major financial decisions and transactions, the clarity, usability, and overall experience of the platform are not just conveniences but necessities.”

Tom McClean, UX Practice lead at DOOR3.

In an industry so rife with complex information and processes, companies must prioritize the best fintech UX design possible to provide an exceptional user experience.

At DOOR3, a UX design agency for banking and fintech, our fintech designers and developers understand the importance of cultivating a positive user experience through user-centric interfaces, increased security, intuitive design, and more, so your users can rest easy knowing their financial information is safe and secure.

FAQ on Fintech UX Design

1. What is fintech UX design and how does it differ from traditional UX design?

Fintech UX design specifically refers to the user experience design for financial technology applications. It differs from traditional UX design in its focus on complex financial data, heightened security needs, and compliance with financial regulations. Fintech UX design combines the principles of standard UX design with the unique requirements of the financial sector, addressing the distinct fintech UX design challenges.

2. How do you approach designing for Fintech?

Designing for Fintech involves understanding the unique fintech UX design challenges and opportunities in the financial services industry and crafting digital experiences that meet user needs while complying with regulatory requirements.

3. How can a UX design agency help with banking and Fintech projects?

A UX design agency specializing in banking and Fintech can provide expertise in understanding user needs, crafting intuitive interfaces, and optimizing digital experiences to drive customer engagement and satisfaction.

4. Why is Fintech User Experience (UX) important?

Fintech UX is crucial for attracting and retaining users, driving adoption of financial products and services, and ultimately, achieving business success in a competitive market.

5. How can I find and hire Fintech UX designers?

You can find and hire Fintech UX designers by partnering with UX design agencies like DOOR3 specializing in UX for financial services, attending industry events, or posting job listings on relevant platforms.

When you hire fintech UX designers from DOOR3 you hire fintech UX designers with unrivaled experience, contact us today.

6. What qualities should I look for in a Fintech UX designer?

When hiring a Fintech UX designer, look for expertise in financial services, proficiency in UX design tools and methodologies, strong problem-solving skills, and a portfolio showcasing successful fintech projects.

7. What are some common UX design challenges in fintech?

UX design challenges in fintech include dealing with complex financial information, ensuring data security and privacy, maintaining regulatory compliance, and making sophisticated financial services accessible to a broad user base. Fintech UX design must address these challenges while providing a seamless and user-friendly experience.

8. How important is fintech UX design in enhancing customer satisfaction?

Fintech UX design plays a crucial role in enhancing customer satisfaction. A well-executed fintech design simplifies complex financial processes, making them more accessible and understandable to users. This not only improves the fintech user experience but also builds trust and loyalty, which are essential in the financial industry.

9. Can good UX design for fintech lead to better financial decision-making for users?

Absolutely. Good UX design for fintech can significantly aid users in making better financial decisions. By presenting information in a clear, concise, and intuitive manner, fintech UX design can help users understand their financial options better and make informed choices. This is particularly important in fintech applications where users are making critical decisions about their finances.

10. What should be the primary focus when developing a fintech user experience?

The primary focus when developing a fintech user experience should be on user trust and security, ease of use, and clarity of information. UX design for fintech should aim to create an experience that is not only aesthetically pleasing but also functional, secure, and compliant with financial regulations. Ensuring that the user feels confident and in control while using the application is key to a successful fintech UX design.